What’s on the Ballot? 2018 Edition

Clarion photo Sophie Weir

Kate Brown holds a 5-point advantage over Knute Buehler in the most recent poll.

October 24, 2018

This year’s midterm election, to be held on Nov. 6, holds importance in both national and state politics. On the national level, 470 positions in Congress are up for vote. This article features an overview of the five Oregon ballot measures, as well as the race for Governor.

Any Oregonian aged 16 or older may register to vote, in order to receive a ballot starting at the age of 18. The state of Oregon offers online voter registration in addition to in-person registration at county offices.

Two Cleveland juniors, Elinor Sterner and Alana Rivas-Scott, volunteer for the BUS Project, a nonprofit designed to “make politics more accessible, more equitable, and more innovative.” They participated in the organization’s Democracy Bowl, a competition among Portland-area high schools to register as many students to vote as possible. They managed to register nearly 60 students, coming in third place. “We could’ve done more, but this was our first year,” said Rivas-Scott.

Timeline

Oct. 10-12: Voters Pamphlets Delivered. Pamphlets can also be found at any Multnomah County Library.

Oct. 16: Voter Registration Deadline.

Oct. 17-22: Ballots Mailed to Voters.

Nov. 6: Election Day. Ballots can be dropped off at any Multnomah County Library as well as the Elections Office located at 1040 SE Morrison.

Governor

Overview: Current Governor Kate Brown and State Representative Knute Buehler face off in the election. Kate Brown, the Democratic candidate, worked as an attorney before joining the Oregon House of Representatives in 1991. Brown served in the Legislature until 2009, when she was elected Secretary of State. In 2015, Brown became Governor upon the resignation of John Kitzhaber. Knute Buehler, the Republican candidate, graduated in 1986 from Oregon State University. He worked as a physician before being elected to the Oregon House of Representatives in 2015, serving the Bend region. The most recent polls show a close race, with Brown leading by a few percentage points. Following are the views of each candidate on five important issues in Oregon today.

Education: Oregon has the third lowest high school graduation rate in the nation, at 74.8 percent. Both candidates recognize this problem and pledge to make amends. Brown notes that education funding is 22 percent higher now than when she took office. She promises to continue with her plans to double funding for career and technical education. She also plans to grow the public preschool program by 10,000 students. Buehler reminds us that Oregon graduation rates remain poor and test scores mediocre. To remedy the problem, he promises to increase K-12 funding by 15 percent in each of the next two budgets. He points to his experience bringing together Democrats and Republicans to draft effective legislation.

Healthcare: In the face of federal budget cuts to the Medicaid program, both candidates promise to ensure that all Oregonians have access to healthcare. Brown points to her statewide increases in healthcare availability, especially for children, and promises to continue the expansion and improvement of these programs. Buehler pledges to increase access to mental health services and take on the problem of bloated costs imposed by pharmaceutical companies. Both candidates have plans to tackle the issue of opioid use.

Housing: Oregon’s population has increased by approximately 300,000 over the past decade. This influx of new residents has caused a housing shortage, which has driven rent and home prices beyond the reach of many families. Brown’s plan to combat the issue involves calls for the spending of $210 million to continue to expand government-owned affordable housing programs. Buehler does not believe that the government should own affordable housing. He plans to accelerate the construction of affordable housing by incentivizing developers with reduced property taxes and fees.

Budget: The state of Oregon is faced with $25.3 billion in debt as a result of generous public employees’ pension benefits. Brown supports plans to increase business taxes to cover this budget gap. Buehler proposes to cut down on the debt by capping annual pension benefits at $100,000 and limiting pay increases to 3.4% per year.

Abortion: Brown and Buehler have both stated that they are pro-choice, and oppose Measure 106. Each of them have supported three recent state laws expanding the availability of contraceptives and birth control. However, last year they disagreed on a law requiring health insurance plans to cover abortions at no out-of pocket cost and funding reproductive health care for women who are not American citizens. Brown supported this measure and Buehler opposed it.

Measure 102

Overview: Measure 102 will allow local governments to use bond revenue to build affordable housing in partnership with businesses and nonprofits. Such projects must be approved by local voters. This measure was proposed to the Oregon Legislature by the City of Portland. It was approved 54-0 by the House and 24-5 by the Senate.

Support: This measure is supported by the city of Portland and several housing advocacy groups. One such group, Yes for Affordable Housing, calls it a “sensible, bipartisan solution,” and that “local housing bond dollars can go farther, helping communities address the need for homes that people can afford.” Ted Wheeler, Portland mayor, agrees, stating that this amendment will allow the City to more effectively make use of its 2016 affordable housing bond worth $258.4 million.

Opposition: No organizations are registered against Measure 102.

Measure 103

Overview: Measure 103 proposes to prohibit enactment of sales taxes on groceries and taxes on revenue of businesses in the food industry. (Income and other taxes for these businesses continue at present rates.) Alcohol, marijuana, and tobacco products would be excluded. Currently, four states have a similar ban on grocery taxes.

Support: This measure is supported by the agriculture and food and drink industries as well as some low income advocacy groups. The Oregon Farm Bureau says that if Measure 97 had passed in 2016, significantly increasing taxes on sales of large businesses,the cost of food would have increased as a result. They assert that this measure “proactively ensures there will be no future tax on grocery sales.” The Oregon State Chamber of Commerce agrees, noting that the food industry is very competitive and cannot afford large tax hikes without passing the costs onto consumers. The Oregon Restaurant and Lodging Association claims that this measure is important because sales taxes on food hit the low-income population hardest.

Opposition: A variety of groups representing healthcare, education, and other interests oppose this measure. One argument is that the food industry should have to face the same tax rates as all other types of businesses. The Oregonian, in an editorial, writes that it is “dangerous to carve out one-off measures that serve only the interests of the initiative backers.” The group Family Forward notes that this measure fails to include important items such as diapers, medicine, and feminine hygiene products. The group Vote No on 103 claims that this measure is poorly written and that existing taxes for farmers and grocers could not be lowered.

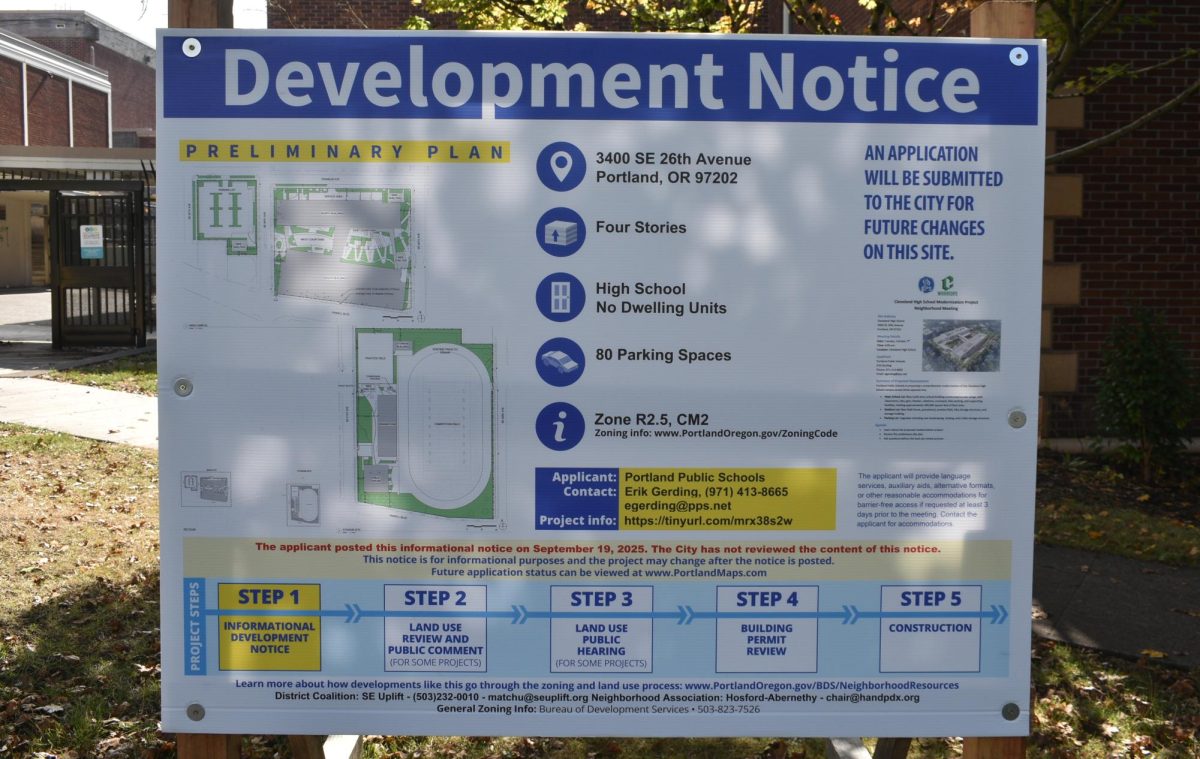

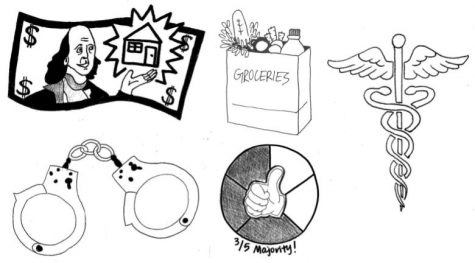

Five important measures covering a wide range of issues are set to appear on the November 6 ballot.

Measure 104

Overview: This measure proposes to require a 3/5ths vote on any legislation increasing state revenue. Currently, only bills which increase tax rates require a 3/5ths vote of both houses in the state legislature. Legislation designed to increase revenue through other means, such as changes in tax exemptions and deductions, only require a majority vote. Under this measure, every law proposing increase state income would have to pass the 3/5ths supermajority vote.

Support: Business interest groups from many sectors of the economy support this measure. The Oregon Association of Realtors points out that last year, Oregon politicians attempted to cut out home mortgage interest and property tax deductions, which save many Oregon homeowners thousands of dollars per year. They claim that these deductions can make homeownership a reality for low to middle class families, and should not be easily done away with. The Oregon Farm Bureau notes that agriculture is a very competitive industry. They assert that “our smallest ranchers, farmers, and loggers are being targeted,” citing three pieces of legislation raising tax burdens on their industry passed during the last two years. The Oregon Small Business Association makes the point that raising taxes is a very important matter and should require broad support. “On a simple-majority vote, politicians increased state revenue by $1 billion at the expense of 250,000 small businesses,” they say.

Opposition: This measure is opposed by a variety of different groups. The most prominent argument is that such a law would make it difficult to expand education, healthcare, housing, recreation, and other programs. AARP Oregon, for example, asserts that this measure would “put funding for healthcare and other senior services at risk.” The Oregon League of Conservation Voters, an environmental group, claims that this measure would result in insufficient responses to wildfires, earthquakes, climate change, and other environmental issues. Another argument is that the measure is too broadly designed, and would result in a struggle to pass even routine bill and fee increases. Also, some groups say that this measure is designed to serve the interests of wealthy people and large businesses. Oregon AFSCME, a public employees’ union, claims that this measure would “lock special interest perks and loopholes into our Constitution.”

Measure 105

Overview: Measure 105 intends to repeal the state law that limits the use of state resources to apprehend people whose only violation of law is related to immigration. The current law was passed in 1987 amid concerns about racial discrimination, making Oregon the first “sanctuary” state in the nation. Since then, seven more states and dozens of cities across the country have adopted similar policies. On a national note, President Donald Trump seeks to dissolve such systems with his January 2017 executive order intending to make sanctuary areas ineligible for federal grants.

Support: The group Stop Oregon Sanctuaries makes several points. First, they argue that the Oregon sanctuary law is disrespectful of federal immigration law and that prohibiting cooperation between agencies is a foolish move. Second, they claim that providing a “sanctuary” for illegal immigrants does not align with the responsibility of government to look out for the safety of its citizens. They say that “thousands of Oregon citizens are victimized year after year by illegal immigrant criminals who should not be here.” They point out that between legal expenses and prison expenditures, illegal immigrants cost Oregon taxpayers $1.2 billion annually.

Opposition: Dozens of civil rights, Latino activist groups, and businesses oppose this measure. ACLU of Oregon reminds us that the current law was passed with almost unanimous support in 1987. They make the point that this law is effective and doing away with would result in widespread civil rights violations. “It protects against unfair targeting, interrogating, and detaining of Oregonians just because police think they are unauthorized immigrants,” they say. Another prominent argument is that many immigrants make valuable contributions to the community and should be welcomed. Mark Parker, CEO of Nike, writes, “We can attest to the unique value that people from diverse backgrounds add to Nike and to Oregon’s culture and economy. Ending Oregon’s sanctuary law will damage Oregon’s long-standing track record as a place that attracts diverse talent from across the globe.” A third argument, posed by the group Oregonians United Against Profiling, is that repealing the current law would make immigrants afraid to report crimes and cooperate with police.

Measure 106

Overview: Measure 106 seeks to prohibit public funds from being spent on abortions or health insurance plans covering abortion. However, consistent with federal law, public money could still be spent on abortions deemed medically necessary or to terminate a pregnancy resulting from rape or incest. If the measure passes, Oregon state government expects to spend less money on abortions, but face greater overall expenses as a result of increased birth rates and corresponding healthcare costs. Currently, 17 states allow public funds to be spent on abortions. This is expected to be a hotly contested measure.

Support: A variety of religious, conservative, and other groups support this measure. “This measure doesn’t stop anyone from choosing an abortion, but rather frees Oregon taxpayers from having to pay for other people’s personal choices,” argues the group WomenVoteYes. Another claim made by several groups is that abortion is currently too easy to access and that many misinformed young women who chose abortion now experience health complications and regret over their decision. Religious groups such as the Oregon Catholic Conference claim that abortions, in particular sex-selective and late-term ones, are immoral and should not be publicly funded. They point out that since 2002, more than 57,000 abortions have been paid for by Oregon taxpayers.

Opposition: Several health, education, and low-income advocacy groups oppose this measure. In addition to the impact on Medicaid recipients, this measure also cuts care for public employees, of which 77,000 are women. “Every Oregonian must be able to decide whether and when to become a parent—no matter how much money they make or how they are insured,” argue the group No Cuts To Care. The minority advocacy group Forward Together claims that this measure “would create new roadblocks for communities of color in Oregon.” Many women’s groups support this measure, saying that an abortion helped them finish high school, college, and move forward in their careers. Planned Parenthood also makes clear that access to abortion is important for young women, and can help them preserve their physical and financial health.